IDS implements EPT V2.0

After public consultation, the Financial Data Exchange Templates group (FinDatEx) published the final version of the European PRIIP Template Version (EPT) v2.0 on 8 February 2022. IDS will be able to provide the EPT in the desired or both versions during the transition phase.

Context

The EPT v2.0 incorporates the necessary changes based on the revised PRIIPs RTS, published in the Official Journal of the European Union on 20 December 2021.

This new version is following the public consultation which was held in accordance with the FinDatEx governance until 22 November 2021. The technical working group reviewed the feedback received and updated the template as appropriate.

Key changes

In more details, the key changes incorporated to EPT v2.0 include:

- Usage of UCITS KIIDs – produced by the Asset Manager – instead of SIDs (Specific Information Documents) – produced by the insurance company – for funds as underlying investment options in Unit Linked Insurance Products (ULIPs): As UCITS KIIDs are now decommissioned, it is under discussion whether insurance companies are allowed to use the funds‘ PRIIPs KIDs instead or have to create SIDs and would therefore depend on narratives and calculated figures delivered in the EPT.

- The change of the Category 2 calculation method requires significantly longer time series, especially for long Recommended Holding Period of Insurance Products.

- The shares in so-called "bail in bonds" are to be reported in line 37. In individual cases, the exact delineation of this term causes difficulties, and it turned out that these investments were not uniformly classified as bail-in eligible by different market data vendors. Therefore, pragmatic solutions had to be found for the implementation of the new standard.

- With the new Category 2 method, insurance companies can no longer adjust Asset Managers‘ calculation results to the Insurance Products‘ Recommended Holding Period, but would need to receive results or time series data from the Asset Managers

- Past performance and previously calculated performance scenarios need to be shown on the Asset Manager’s web site, and the link must be disclosed in the EPT.

What happens next?

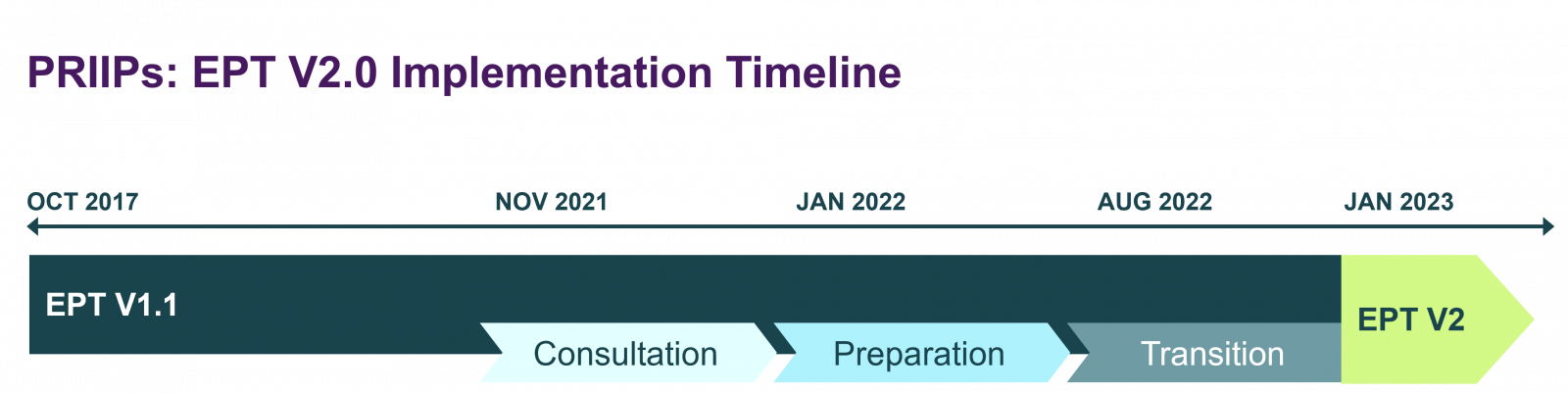

The EPT is intended to be used for products sold from January 2023 onwards. It is important that data contained in the EPT is communicated by asset managers to insurers in good time before this date. The market is therefore expected to start preparing for the new template as the first EPT 2.0 will start to be published in August 2022. The EPT v1.1 is expected to be discontinued at the end of 2022.

The derived Comfort European PRIIPs Template (CEPT v2.0) containing supplementary information has been updated by the FinDaTex PRIIPs technical working group. It was under public consultation until 31 March 2022. The final version has not been yet released.

How can IDS help?

Our PRIIPs Service ensures that you are compliant with the latest PRIIPS regulation changes. IDS experts are preparing for the new template and will be able to provide the first EPT v2.0 as of August 2022 and both versions during the transition phase.