ESG Data Intelligence for investment pros

Valid data is necessary to anchor the ESG dimension in investment processes. Analytics are needed for ratings and risk indicators. Reports must be in the required templates. A proven, scalable solution that envisions tomorrow’s ESG demands today: Data Intelligence from IDS – powered by Allianz.

Your navigator for the entire ESG journey

From fulfilling SFDR obligations to seizing opportunities – IDS provides a strategic ESG data management approach that makes a difference. We use a cross-vendor, integrated data solution covering all asset classes.

That encompasses validated calculation of ESG exposures, taxonomy compliance and PAI indicators, including carbon footprint. Flexibly configurable reporting is available in all required formats and EU languages – complete with audit-proof monitoring. Why settle for less?

Forward-thinking data strategy needed

SFDR, PAI, Taxonomies: Level 1 of the Sustainable Finance Disclosure Regulation (SFDR) in March 2021 was just the beginning of a regulatory journey that is gaining momentum. From as early as mid-year 2021, larger investment companies are required to disclose their Principal Adverse Impact (PAI) policies. Disclosure of the first two (of six) taxonomy categories for sustainable financial products starts at the end of 2021 – followed by related investor disclosures from early 2022 and quantitative PAI disclosures from mid-2023.

SFDR entry into force

SFDR: consideration of PAI indicators at entity level (major financial market participants)

KVGs with 500+ employees are subject to disclosure requirements.

Taxonomy: disclosure requirements for environmental objectives 1 and 2

1st environmental objective: climate change mitigation

2nd environmental objective: adaption to climate change

Taxonomy: deadline to develop draft RTS on environmental objectives 3 - 6

3rd environmental objective: sustainable use and protection of water and marine resources

4th environmental objective: transition to a circular economy

5th environmental objective: pollution prevention and control

6th environmental objective: protection and restoration of biodiversity and ecosystems

Integration of sustainability risks and factors in MiFID II, IDD and Solvency II

SFDR RTS: entry into force | SFDR: disclosure of PAI indicators at product level | Taxonomy: disclosure requirements on environmental objectives 3 - 6 | Taxonomy: Complementary Climate Delegated Act (gas and nuclear)

SFDR RTS: updated to include fossil gas and nuclear energy.

SFDR: PAI indicators at company level (first reference period year 2022)

CSRD: disclosure requirements for all companies subject to the NFRD (reporting in 2025, FY 2024)

SFDR: PAI indicators at company level (second reference period year 2023)

CSRD: disclosure requirements for all large companies (reporting in 2026, FY 2025)

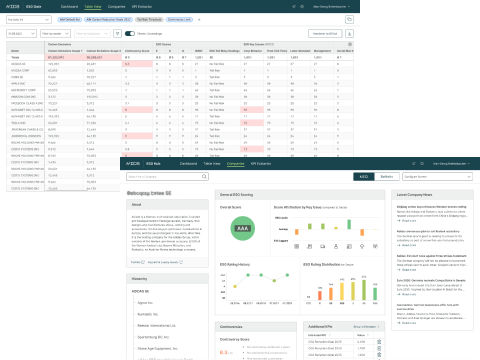

The ESG solution by IDS.

The ESG data management solution from IDS is already being used for more than 2500 investment products across asset classes. Our experience and expertise in this field ensure reliable compliance with all current and future SFDR disclosure requirements. We see to it that your data is action-ready for portfolio management and monitoring:

- ESG-relevant exposures for investments and (optionally) underlying positions

- Regulatory ESG scores at investment, portfolio and company level

- Principal Adverse Impact (PAI) indicators, whether mandatory or optional, including carbon footprint

- Proportion of EU taxonomy-compliant investments in portfolio

One solution - all the benefits

FAQ

Which ESG data vendors does IDS work with?

Thanks to the open architecture of the ESG platform, IDS can integrate a variety of vendors such as MSCI, Arabesque or Refinitiv. We can enrich and aggregate their data, whether it is ratings, scores or controversies & business involvement. We can even integrate internal ratings and scores.

Can IDS help me fulfill all of the SFDR requirements?

Our ESG solution is already capable of generating the data to be disclosed in the future and populating all required reporting formats – at company and portfolio level. This includes SFDR levels 1 and 2, calculating the proportion of EU taxonomy-compliant investments in the portfolio, PAIs incl. quality-assured carbon footprint and output via ESG factsheets and European ESG Templates (EET). Future requirements can also be implemented before they come into force.

How does IDS differ professionally from other ESG providers?

IDS is partnered with Allianz for ESG data solutions. Our jointly developed tools, thoroughly tested in live operational settings, give us the special technical expertise required of an ESG pioneer in Europe – on both the asset owner and asset manager side. In addition, we participate in special committees and expert forums and work with other market participants to develop industry standards for the dissemination of ESG data – such as FinDaTex, European ESG Template (EET).

Can IDS create the documents in my specific layout?

We have been producing documents such as annual/semi-annual reports, UCITS KIIDs, PRIIPs KIDs and factsheets using the specific layout requirements of our customers for many years – reliably, efficiently and in high graphic quality. If required, we also take care of the translation of narratives/phrases and texts into any required language and output the texts in all necessary font formats.

How is ESG implemented in government bonds, real estate and alternative asset classes?

IDS supports the determination of ESG country ratings and calculates the PAI indicators required for countries. Likewise, we provide a configurable infrastructure for decentralized collection of ESG data, such as types of use or energy efficiencies of real estate.

In which formats will I receive the ESG-relevant information back from IDS?

All analyses performed by IDS can be returned to asset owners and asset managers via flexibly configurable data formats at any aggregation level and imported, for example, into their web frontend or portal solutions. We produce the European ESG Template (EET) for our clients; the required documents already comply with Article 173 of the French Energy Transition Law.

How is the monitoring of ESG criteria in funds supported?

We support you in mandatory monitoring of the information published by your portfolio management pursuant to the SFDR. We provide the relevant data packets via a frontend on a “need-to-know” basis and ensure audit-proof implementation of the review and approval process.

Can IDS enrich data for me?

We obtain all necessary portfolio, investment and company data for you from all relevant sources, consolidate the data, ensure the required data quality and store the data for you in a standardized form – across all common investment vehicles. If required, we can enrich your data with all necessary information and provide a look-through.

How does IDS ensure that processes are audit-proof?

All data is managed on IDS' central ISAE 3402-compliant data platform. Our systems and processes meet or exceed international IT security standards and are ISO 27001 certified. All enrichments, transformations or changes to data delivered by IDS can be traced at any time, ensuring the full-time audit-readiness of the result data. IDS clients can continuously monitor the calculated ESG data via the IDS frontend and thus verifiably fulfill all required auditing and release obligations. If necessary, we can have our reports assessed by an independent auditor and provide you with the requisite test certificates.

Can IDS assist with other ESG issues beyond SFDR?

Our range of services extends far beyond an SFDR reporting package. We support our clients in integrating ESG into all primary and secondary processes of the investment value chain – e.g., investment screening, risk measurement, regulatory or performance reporting. Contact us as well for assistance with portfolio decarbonization, climate stress testing/reporting or Article 173 FETL reporting.